Take the Risk out of Advice: Death Income benefits

ICON has partnered with some of SA's leading Death Income* providers; Sanlam, Hollard, Capital Legacy, and Elevate Life. These providers have various benefit options that pay your clients' estate, spouse, children, or key beneficiaries in the event of them passing away.

*Also referred to as “Life Income”

CHILDREN

TAKE CARE OF CHILDCARE COSTS MAINTENANCE PAYMENTS

SINGLE PARENT FAMILIES

GREAT SOLUTION FOR AN EDUCATION BENEFIT

Ensure the child’s holistic needs are taken care of up to a specfic age or for a set period of time. The proceeds of the claim can be paid to a guardian, trust, or a trusted individual, if the children are minors.

SPOUSE

COVER SPOUSE'S LIVING EXPENSES UNTIL RETIREMENT

SUPPLEMENT RETIREMENT SAVINGS FOR YOUR SPOUSE WITH A WHOLE OF LIFE INCOME BENEFIT

EX-SPOUSE MAINTENANCE

Choose a specific time period for the income payments, whole of life, or until clients' selected retirement age of 55, 60, 65 or 70.

BUSINESSES

The Death Income benefit for businesses ensures that the monthly operating expenses of your business will continue to be paid in the event of your / your client’s death, as a business owner or key person.

ESTATE LIQUIDITY

Use Death Income benefits to provide dependents and loved ones with a regular monthly income for a period of 6, 12 or 24 months whilst the estate is wound up.

LOOKING AFTER PARENTS

There are more and more people supporting their parents financially/ Selecting a Whole of Life Death Income benefit is the only life insurance benefit available that perfectly provides for this need in the ‘Sandwich’ generation of children supporting parents.

Why Life Income benefits offer smart advice?

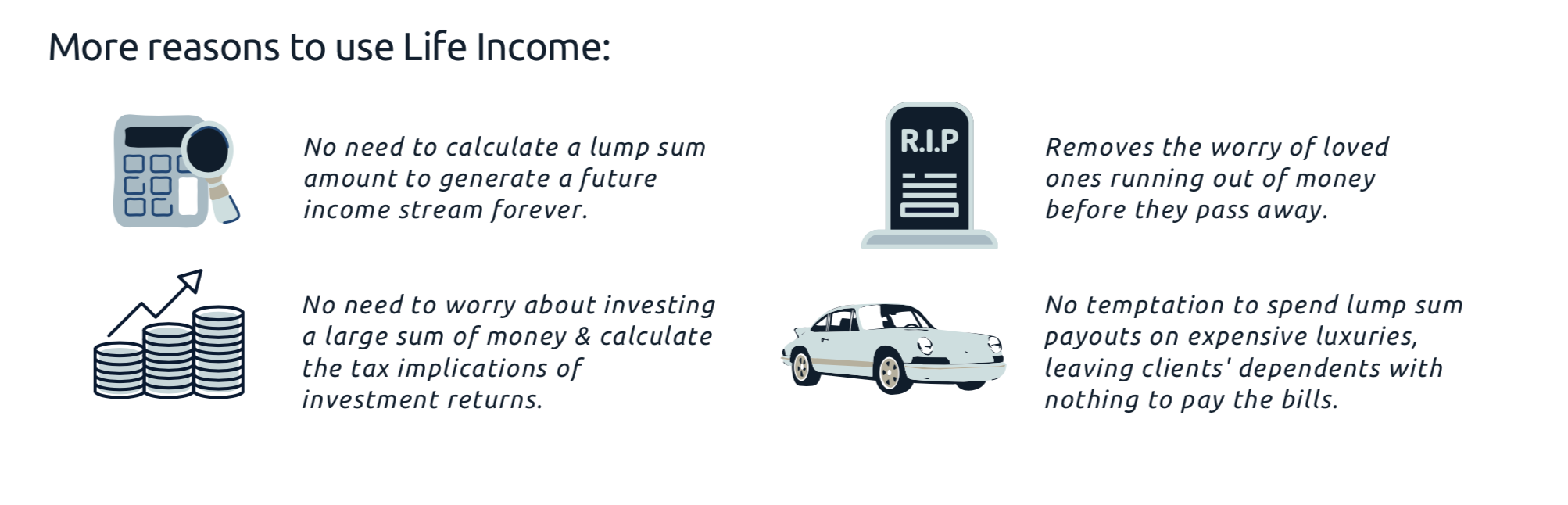

Using Death Income benefits, your clients can be sufficiently insured from day 1, and not over insured later in life (no premium wastage, or overinsurance!).

The Great Irony: The decreasing need for life cover as your client' gets older, yet policy benefits typically increase year-on-year; leaving clients over-insured with expensive premiums and policies that they are too afraid of cancelling.

DID YOU KNOW?

Death Income benefits are approximately 30% more affordable than the equivalent lump sum, and the comparison savings are hugely significant over a long period of time! The premium savings could be put towards saving and investments, and generate more wealth for your client.

Better value, better premiums.

A GREAT DEBATE

How can you, an adviser, still create practice revenue without receiving a lump sum to invest?

The premium savings during the policy lifetime provide opportunities to increase risk cover or allocate towards savings / investments.

How often does a client spend too much of the money before it gets back to you to invest? Or doesn't come back to you at all?

With income benefits, you have the opportunity to “inherit” a client that now has a guaranteed income and requires financial planning and advice.

With a combination of income and a lump sum pay- out; the income payments, even for a short term period, removes the stress of winding up the estate or needing to draw income form investments.